Introduction

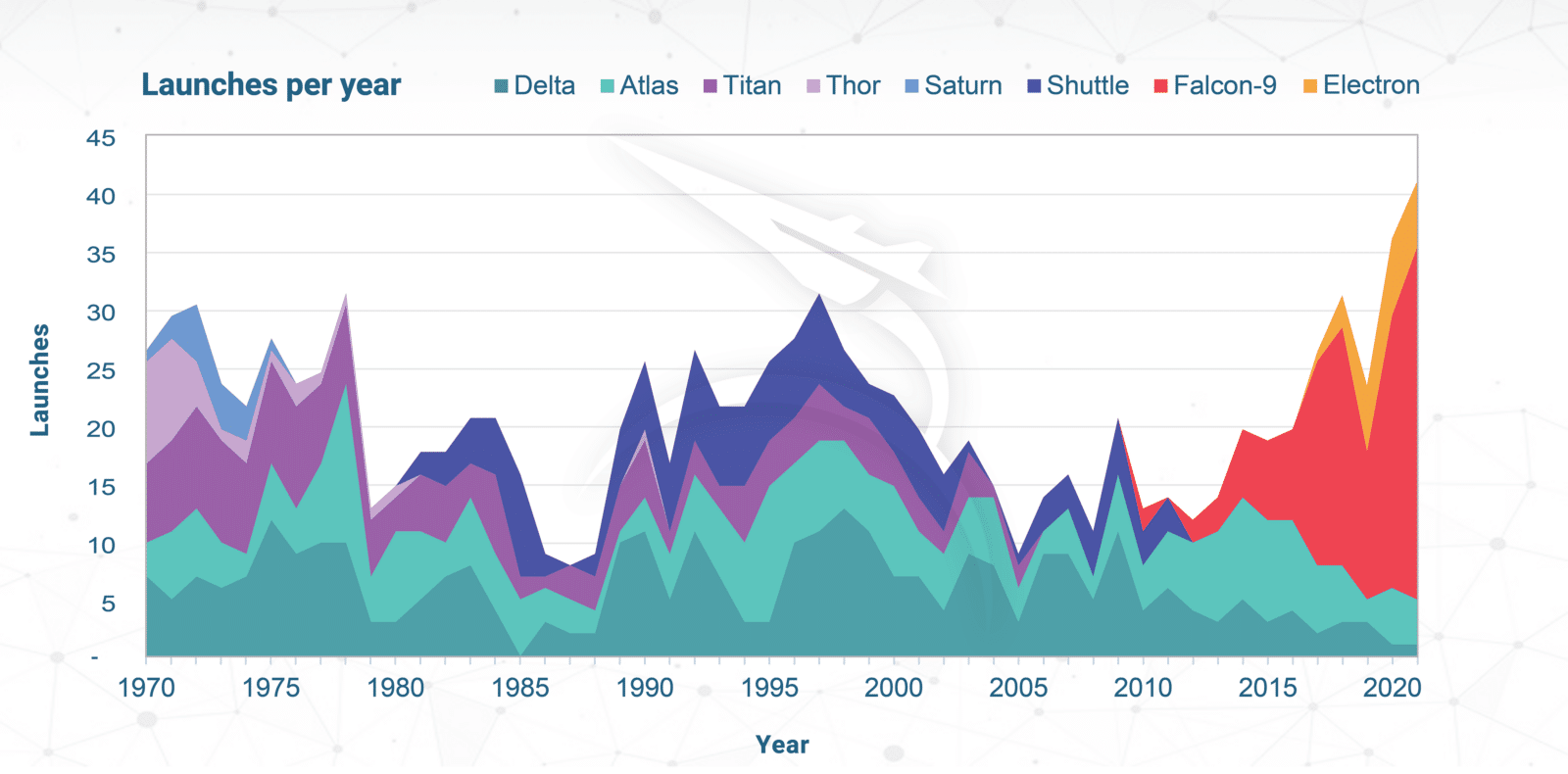

On September 28th, 2008, SpaceX successfully launched their Falcon 1 vehicle to orbit for the first time. The launch marked a new era for the space industry as the 200 kg payload rocket became the first privately funded, liquid-fueled vehicle to be developed and reach orbit [1]. Thirteen years later, SpaceX accounted for more than 87% of all launches in the U.S. Today many more privately funded companies have started testing of their own launch vehicles with hopes of entering the market within the next few years [2].

The success of the private launch sector led NASA to increase private aerospace cooperation and begin providing government contracts to proven and in-development launchers. The emergence of such contracts as well as an increase in commercial launch demand has enabled the space launch industry to rapidly expand. There are now more than 10 heavy and medium launch vehicles and more than 70 small launch vehicles in various phases of development or operation within the U.S. alone [3]. While this presents opportunity for competition, space launch demand may not be sufficient to sustain this many companies and could lead to market saturation and consolidation. In this article, we aim to explore the launch industry and evaluate the economic viability of the projected launch industry versus the projected amount of anticipated payload over the next 10 years to determine how many launch vehicles are truly needed.

Launch Market Overview

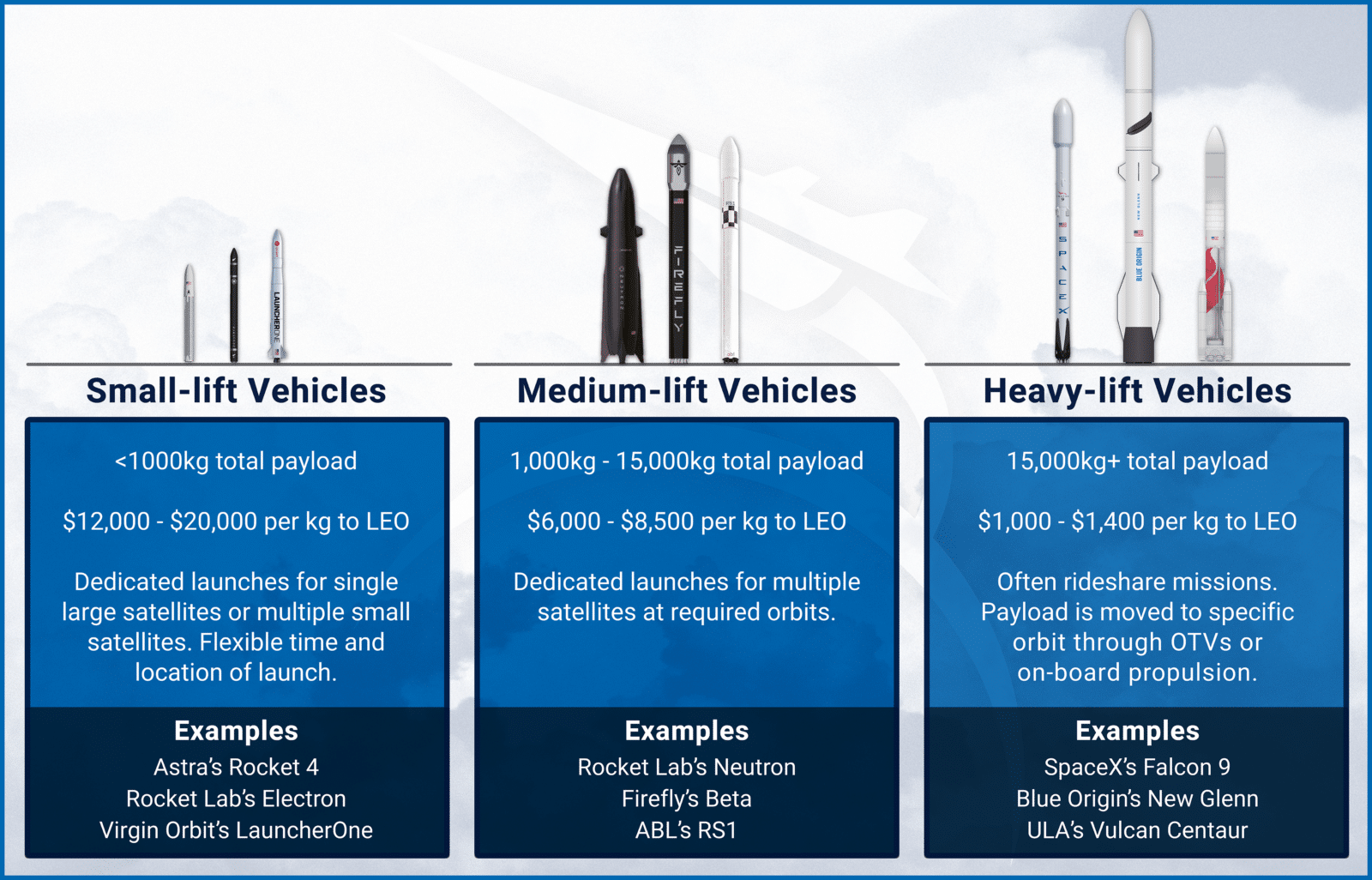

Within the current state of the private U.S. space launch market, we will be exploring heavy, medium, and small lift vehicles.

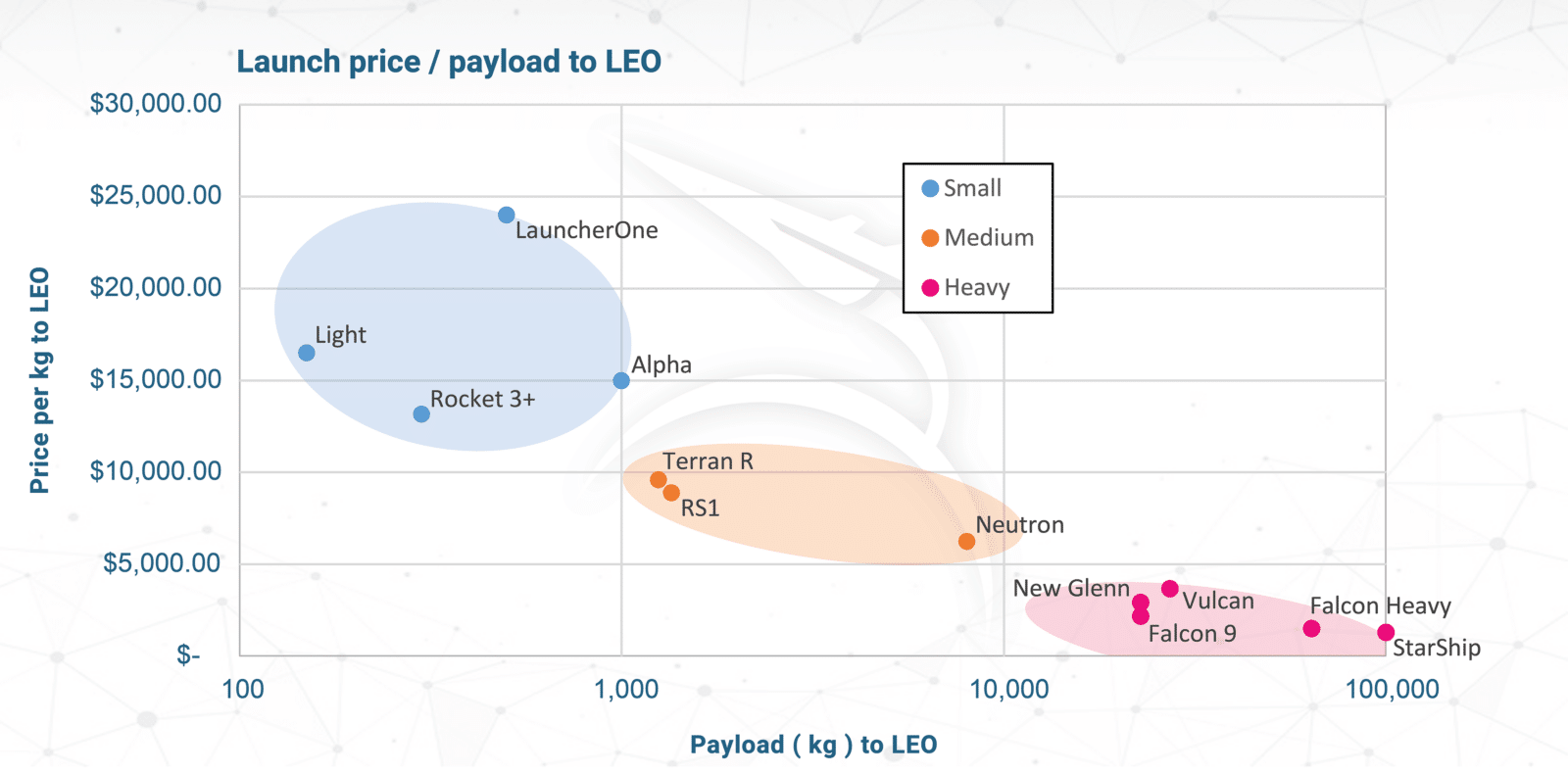

The main difference between the three launch vehicle classes is payload capacity to Low Earth Orbit (LEO). For this analysis, heavy launchers are those capable of sending 15,000 kg or more of payload mass to LEO, which would include vehicles like SpaceX’s Falcon 9 and Blue Origin’s New Glenn. Medium sized launchers have capabilities ranging from 1,000 kg to 15,000 kg, such as Firefly’s Alpha and Rocket Lab’s Neutron. Small launchers cover anything below 1,000 kg and includes vehicles like Astra Space’s upcoming Rocket 4 and Virgin Orbit’s LauncherOne. Each class of launcher is suited for different mission types and vary in price to reflect customer requirements (See Figure 2.1).

Heavy launchers often provide services at a much lower price per kilogram due to multiple fixed operating costs that are amortized over their larger payloads, relative to the increased burden of fixed costs on smaller launchers (see Figure 2.2). This is usually the preferred option for customers with tighter budgets or with payloads that don’t have sensitive orbit or time requirements. Typically, payloads share a ride with multiple customers and are delivered to a general region in LEO that is most convenient for the launcher. From there, satellites use on-board propulsion or orbital transfer vehicles (OTVs) to reach their desired destination, which may take some time depending on the orbit. In most situations this remains the cheapest option, but some customers opt for the dedicated medium or small launches for their payloads. Dedicated launches give users more control over their payloads, with more flexible launch site, scheduling, and orbital delivery options for their payload. Ultimately, the decision on which launcher to pick is a matter of various factors and will largely depend on the needs of the customer. According to a report by the FAA, vehicle reliability, performance, suitability, and price play the biggest factors when it comes to selecting a launcher [4].

Market Share and Payload Projections

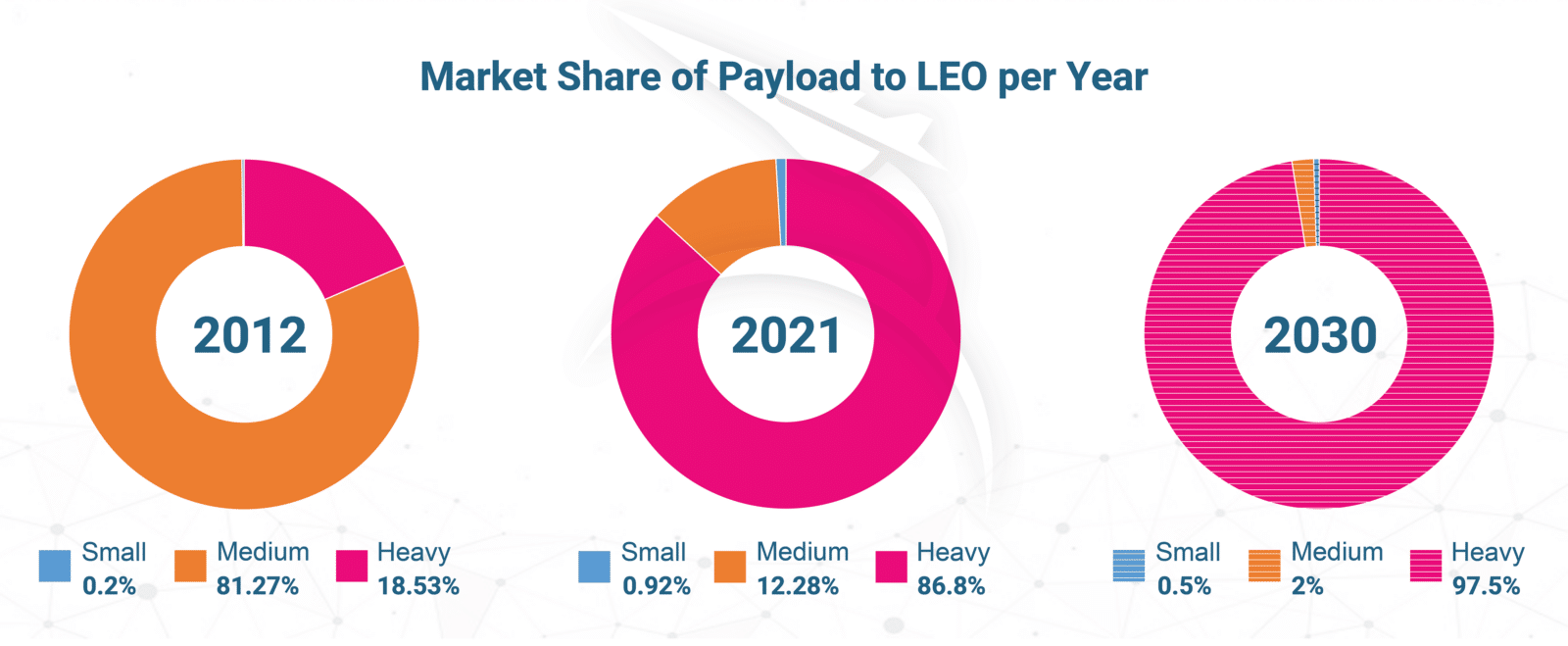

Compared to 2012, heavy-lift vehicles have gradually taken over a larger fraction of payload delivered to LEO that can be addressed by U.S.-based launchers, and we expect them to maintain that dominant share of payload delivery for the rest of this decade (see Figure 3.3). Considering these market share projections, we used a 20-40% Compounded Annual Growth Rate (CAGR) for payload to LEO and produced a number for the maximum feasible vehicles per launch class, based on the economic viability of business operations and an equal market share within each class. This growth rate accounts for the existence of government contracts that are provided to private U.S. based launch providers at a growing rate. A sensitivity analysis was conducted and shown in the Appendix to account for a space launch market with limited government involvement. Within each class, a weighted average mass calculation was used to determine payload to LEO. For heavy launchers, considering vehicles such as SpaceX’s Falcon 9, Falcon Heavy, and Starship as well as Blue Origin’s New Glenn and ULA’s Vulcan Centaur, we determined a 60,000 kg payload to LEO per launch as a representative estimate of this vehicle class by 2030. Medium launchers, whose capacity ranges from 1,000 kg to 15,000 kg, represent mostly in-development vehicles such as Rocket Lab’s Neutron and Firefly’s Beta and thus yield a weighted average 8,500 kg to LEO per launch by 2030. Finally, small launchers average to 500 kg per launch and include vehicles such as Astra Space’s Rocket 3, Virgin Orbit’s LauncherOne, and Rocket Lab’s Electron.

Within each launch vehicle class, the total number of launches needed to address the projected annual payload mass to orbit was determined using an average payload capacity for that class. This was divided by the number of launches needed to breakeven each year for a single vehicle. The resulting value provided the maximum number of economically feasible launch vehicles for a given year based on equal market share. The breakeven calculations include cost of labor, development, and launch, as well as a 5-10% contingency margin to account for unexpected expenses or changes in demand. The industry expects a general decrease in launch costs for operators and launch price for consumers. An industry analysis by Citigroup forecasts launch costs for operators of $100 per kg to LEO by 2040, which would be reflected in significantly lower launch prices for customers [6]. The projections in this article use this assumption, with launch costs and prices dropping while profit margins slightly increase for all vehicle classes.

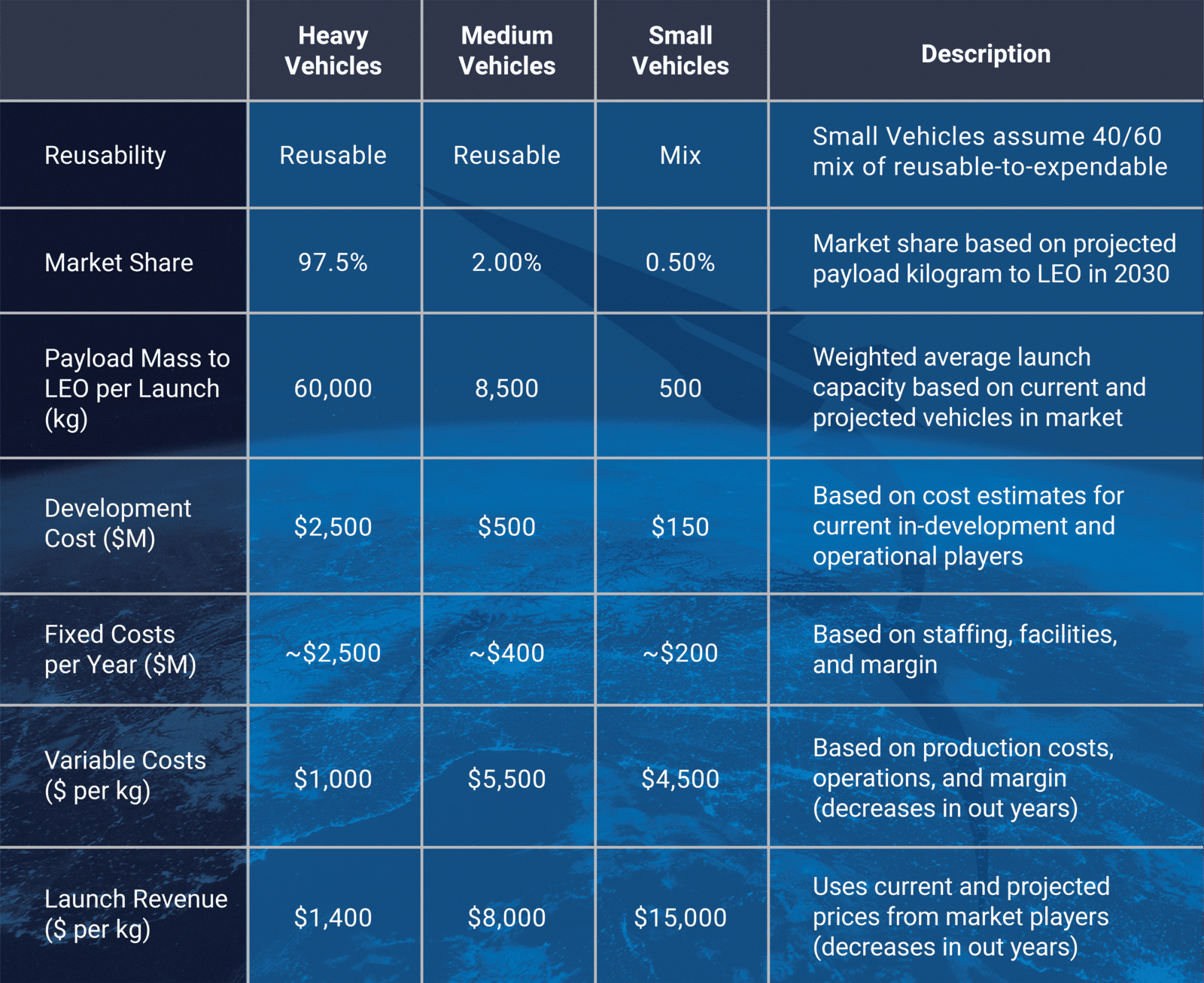

Launch costs vary between vehicle classes but also vehicle types. Reusable vehicles often have increased development costs due to the extra time, labor, and design requirements needed to create such a vehicle, but can achieve lower costs once regularly launching. Non-reusable vehicles are cheaper to develop but will always require a new vehicle to be built per launch. This leads to higher launch costs and prices, while decreasing profit margins, and ultimately increasing the necessary launch cadence to break-even. Reusability is favored amongst heavy and medium-lift vehicles, with almost all vehicles in both classes pursuing full or partial reusability. Considering their larger vehicle size, it makes most economic sense for these launchers to decrease launch costs and prices while taking on extra development costs. The situation is different for small launchers, where only ~40% of vehicles in-development have plans to be reusable. Most companies in this market space prefer to scale up production of simpler and smaller vehicles rather than increase development time and costs to develop partial or full reusability. However, this places those companies at risk if they are unable to achieve high launch and production cadence, their increased launch prices and costs would place them out of contention for market share within the small-lift vehicle market space. For this analysis, heavy and medium vehicles will be considered reusable, and thus take on additional development costs while increasing profit margins. The small-lift vehicle market will be split based on current reusability status, with 40% of vehicles either fully or partially reusable, and the remainder with no intention of developing reusability by 2030. See table 3.1 for basic assumptions and metrics used for calculations.

Table 3.1 Basic Assumptions for this Assessment

Analysis of Results

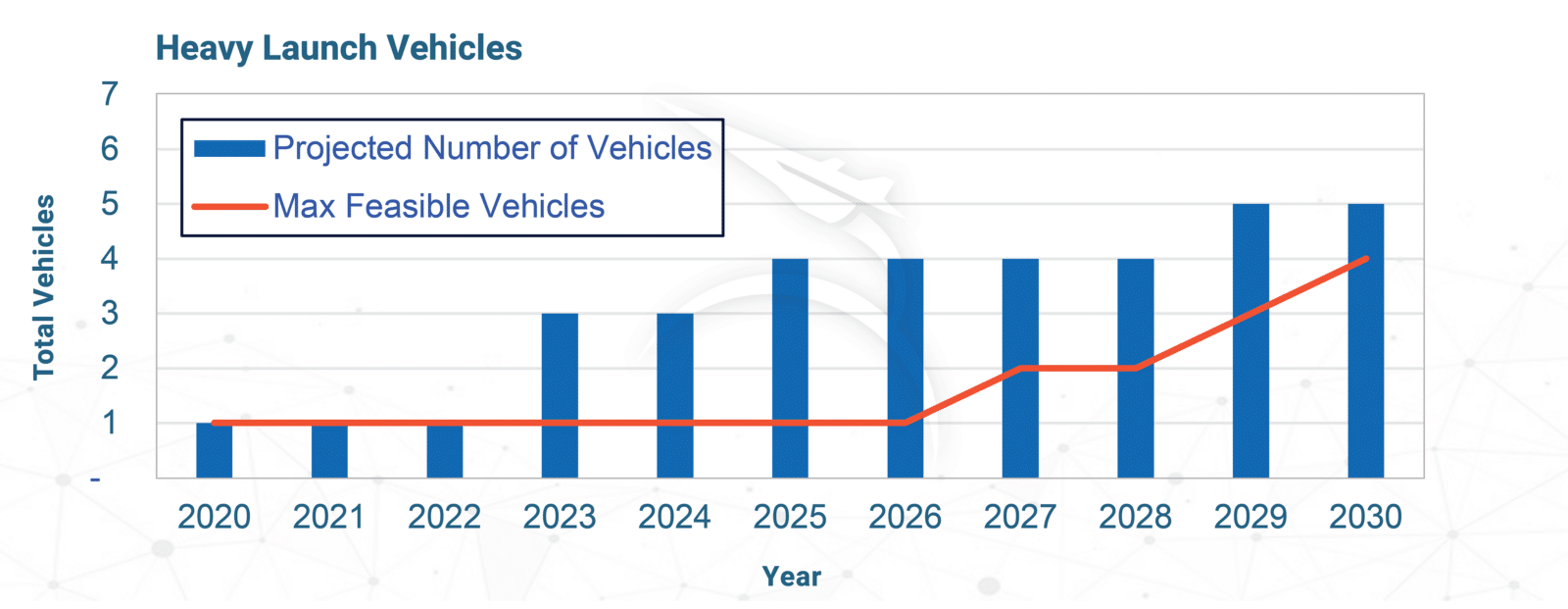

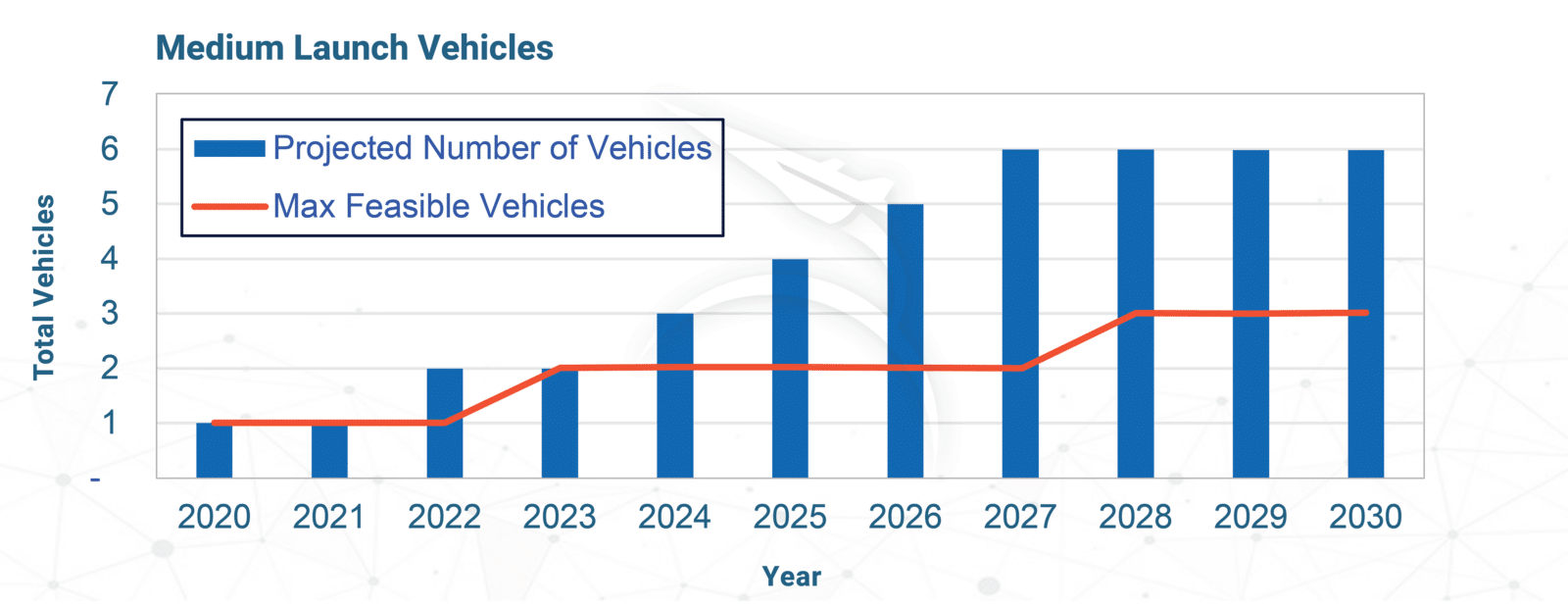

Considering these assumptions and a 40% payload CAGR, there is a notable difference between total addressable market and the current operational or in-development vehicles for all three classes ( see Figures 4.1 a, b, and c ).

While we expect heavy launchers to garner the most demand, the market currently anticipates 5 heavy-lift launch vehicles by 2030 while our projections yield a maximum of 4 vehicles existing sustainably. Among these existing or in-development vehicles are SpaceX’s Falcon 9, Heavy, and Starship, as well as Blue Origin’s New Glenn and ULA’s Vulcan Centaur. Being the largest out of the three classes, heavy-lift vehicles often boast development costs of over $2 billion but advertise the lowest cost per kg to LEO. We expect there to be a significant market for their services as price remains the primary consideration for customers. Advancements in spacecraft propulsion technology and greater availability of OTVs will further lower prices for customers to reach their desired orbits, and cement heavy-lift vehicles as the main providers of space launch. Despite this, our projections maintain that the demand in this vehicle class will not be able to sustain the large development and operational costs for all five vehicles, and consolidation efforts will follow for the least efficient player in this market space.

While rideshare garners most of the attention in the space launch industry, customers who prefer the flexibility and increased control over their payload will pay the premium for dedicated launches using small and medium-lift vehicles. The medium sized vehicle class is headlined by in-development rockets such as Rocket Lab’s Neutron and Firefly’s Beta, with average development costs of $500 million, while maintaining launch prices of $8,000 per kg to LEO. Regardless of their lower expected launch cadence of 40-50 launches by 2030, we expect a market for a maximum of 3 medium-lift vehicles. The market for dedicated launches is most suitable for smaller satellites who may not be able to board a rideshare launch during the timeframe they need. Considering their size, medium-lift dedicated launches garner most of their demand from multiple small satellite launches from the same operator, or heavier satellites that seek specific launch times and locations. We do not see enough demand for this service to maintain the 4 companies that the market currently expects.

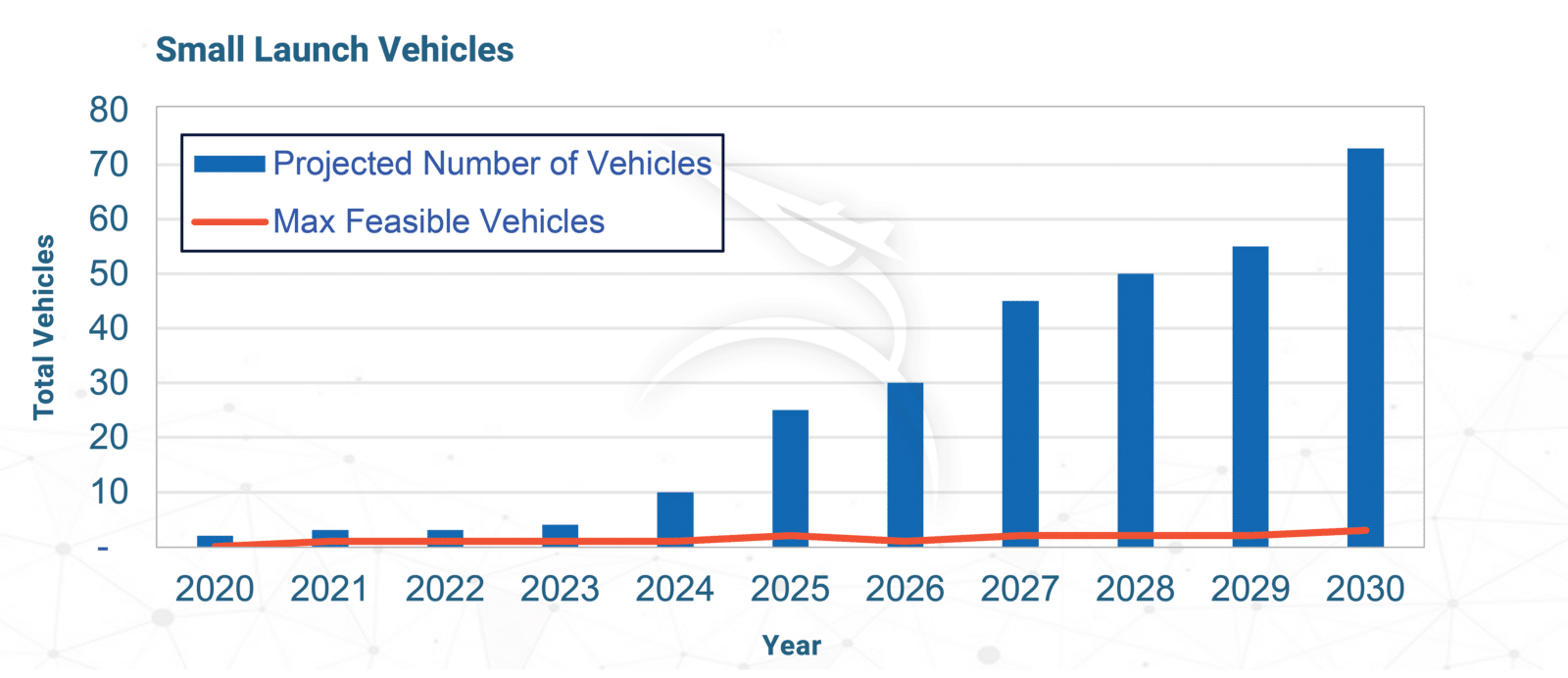

Small launchers are expected to capture most of the dedicated launch market measured by annual number of launches (not payload mass). Their smaller size extends their flexibility in terms of launch location and time, as well as lower launch prices per launch than medium-lift vehicles. With almost 180-200 launches expected for the year 2030, small-lift vehicles carry an average of 500 kg to LEO and require development costs of $150 million for non-reusable, and $200 million for reusable vehicles. Using our projections for breakeven revenue and launches per year, we expect a market for 5 small launch vehicles. Due to their smaller size and development cost, the small launch market has the lowest barriers to entry and has been an entry point for many startups seeking to join the space launch and logistics market. Within the U.S. alone, 73 launch vehicles have been announced as of 2021, with most in development but aiming to launch by 2030. The large difference in number of vehicles in-development compared to what we see as economically feasible is largely due to a disconnect between company estimates and the total addressable market. Some small launchers had expectations of more than 300 launches a year by 2025 [7], while the FAA projects 160 launches from the entire market for the same year [8]. We thus do not see enough demand to sustain most of these launchers, and market consolidation, product pivoting, and/or discontinuation of companies is likely to follow.

Using a more conservative approach and a 20% payload CAGR, the market expectations heavily drop and are further out of line of current operational or in-development vehicles. Using our same methodology on this more conservative view of launch market growth, the U.S. market can sustain even fewer future launch operators. The total market launches for 2030 are 134, with enough to sustain one heavy, one medium, and two small launch vehicles. In both estimates, we are considering revenues solely from space launch operations. Some space launch companies, such as SpaceX and Rocket Lab, have expanded their services to enter higher profit margin space logistics markets and spread some fixed costs. While this may increase space launch companies’ profitability and reduce the number of required launches, it will only enable marginally more launch vehicles to enter the market and therefore, has minimal impact on our analysis, especially in the small launch vehicle class.

Conclusion

Low-cost access to space has been identified as the biggest enabler of a commercial space economy. Competition is helping drive down launch prices as launch providers lower their costs with improved manufacturing techniques and better technology. With that, the amount of payload per year sent to orbit is expected to greatly increase over the next decade and a plethora of companies are aiming to provide a ride for these payloads. However, the analysis conducted by our SpaceWorks Commercial & Advisory team indicates that there is already an oversaturation of launch companies, especially in the small launch vehicle class that has 73 companies with vehicles in various phases of development or operation. The launch providers that can establish a market presence early and prove they can reliably deliver customer payloads will have the best chance at long-term sustainability. New entrants later in the decade will likely have to leverage disruptive technology and/or significantly lower price points to capture market share.

Ultimately, with anticipated market saturation and recent economic conditions, the space launch industry is likely to see consolidation of resources, companies pivoting to adjacent markets (engine providers, etc.), and/or companies failing to reach operations. The launch industry is vital to the overall space economy, but the metaphorical table is almost full, and a lot of companies are still looking for a seat.

Hayden Magill | Economic Analyst

Mr. Hayden Magill is an Economic Analyst at SpaceWorks focusing on parametric cost estimation, business case assessments, and advanced modeling & simulation techniques for aerospace projects. Mr. Magill was the lead analyst for the NASA Commercial Hypersonic Transportation Market Study conducted with Deloitte and the Air Force Research Laboratory (AFRL) future liquid engine propulsion concepts project. While at the University of Georgia, he earned a Bachelor of Science (B.S.) in Mechanical Engineering and a STEM Master of Business Administration (MBA).

Chris Topalov | Junior Economic Analyst

Mr. Chris Topalov is an Economic Analyst intern at SpaceWorks. His experience also includes internships with The Coca-Cola Company, Martenson Hasbrouck & Simon, and The Mather Group. Mr. Topalov is pursuing a Bachelor of Science in Industrial Engineering with a concentration in Economic and Financial Systems from the Georgia Institute of Technology. He serves in leadership roles with the school’s Yellow Jacket Space Program and GTSF Investments Committee.