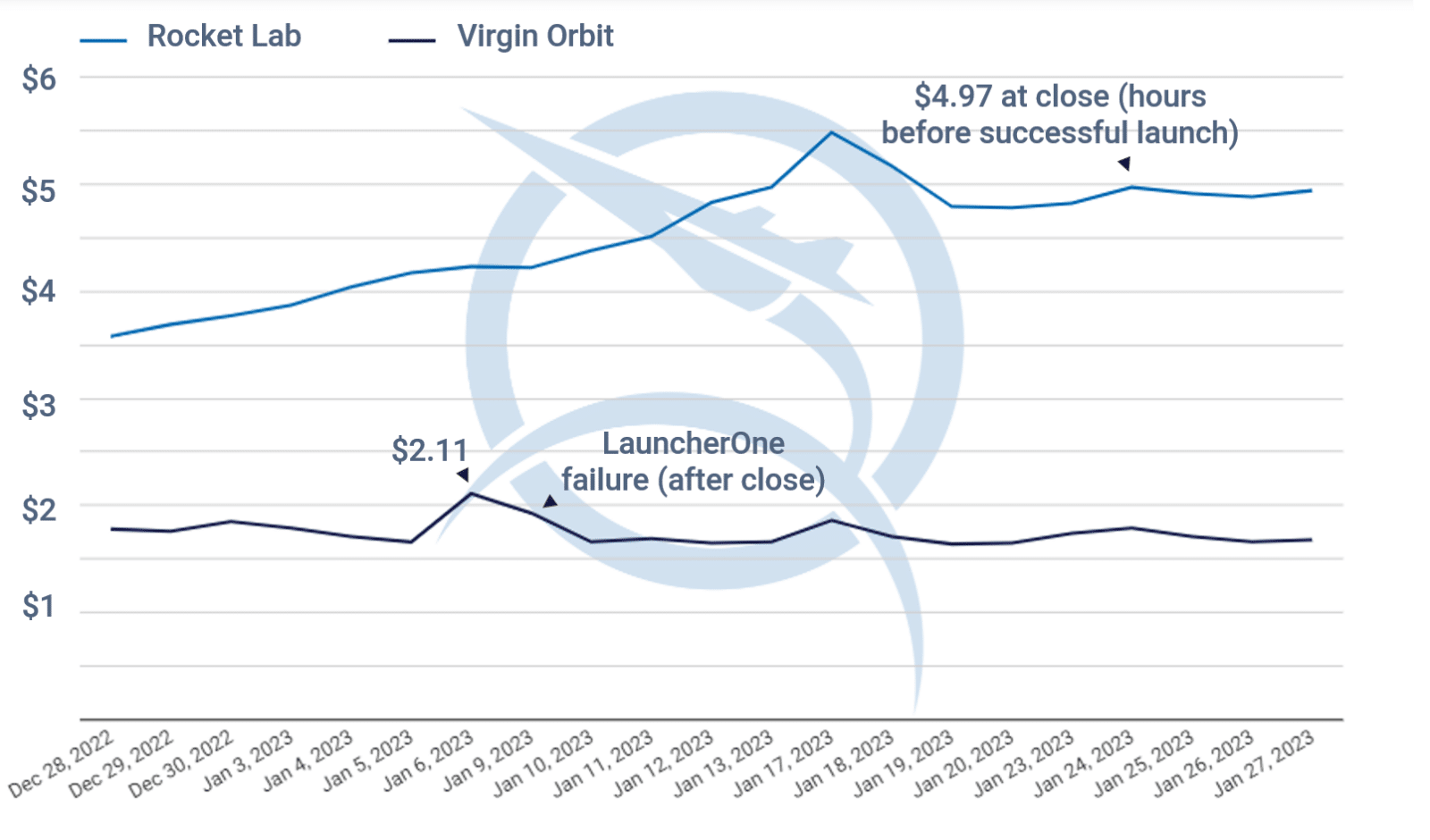

After an underwhelming Q3 financial report and months of waiting to launch from Spaceport Cornwall, Virgin Orbit (VORB) saw its stock steadily decline, reaching an all-time low of just over $1.60 per share in the couple of weeks prior to their most recent launch. Following the announcement that the company had cleared its final hurdle to conduct its first commercial launch from the U.K., Virgin Orbit’s stock price jumped to $2.11 in the days before that launch (a 32% rise). However, this rise was extremely short-lived as LauncherOne failed to reach orbit on January 9th. Investors had an immediate negative reaction, and VORB dropped back down to $1.60 per share and has fluctuated around $1.65 – $1.80 since. The longer than expected delays leading up to the U.K. launch effectively destroyed any positive momentum VORB achieved after 4 successful launches in a row. The delays also put a greater spotlight on their latest launch, and with the failure, long-term confidence in the stock seems to be lacking.

Unfortunately for public space companies, especially those that primarily provide launch services, headlines perceived to be negative tend to have excessive downward impact on share prices (Satixfy registered additional shares to be sold and their stock price dropped from $7.23 to $2.29 within one day). Even if headlines are positive, stocks will either follow the broader market’s prevailing trends that week or experience a short-term spike followed by a reactive selloff opportunity, robbing the space sector of sustainable stock price gains that might strengthen investor confidence. Rocket Lab epitomizes the first behavior. By most accounts, its stock should be riding high. The company had nine successful launches with no failures last year and then kicked off 2023 with their first successful launch from U.S. soil on January 24th. But even with those successes, their stock price mostly tracked with the broader market and saw marginal gains, if any, after their launches. As of January 30th, Rocket Lab’s stock price closed at $4.88 per share and has yet to close above $4.97 since closing at that point hours before its latest successful launch. Apparently, success in this current market is only enough to keep a stock alive and relatively stable enough to hopefully see better days.

With a higher projected launch cadence for Rocket Lab this year (14), we’ll see if more frequent, successful launches will be enough to generate any sustainable positive momentum for their stock price and potentially start to break the negative stigma currently surrounding public space companies. In our opinion, public investors are still not ready to buy-and-hold in these NewSpace stocks over the long run. Risky business models and risky launch outcomes create a skittish market that reacts quickly to failure but doesn’t immediately reward success. More than one public space company probably needs to show positive financials to build faith in the space industry as a whole before we start to see any of these companies truly grow value in the public market.