On November 22nd, 2011, SpaceWorks debuted the first ever dedicated small satellite market research report, the ‘SpaceWorks’ Nano/Microsatellite Launch Demand Assessment’. Nearly a decade later, the industry (and our flagship annual report) look quite a bit different than they did back then. As we celebrate 10 years of the SpaceWorks Nano/Microsatellite Market Forecast, and turn our eyes to what lies ahead in the 2020s, we are also taking time to look back. This year’s forecast is filled with insights, both into the events that birthed that small satellite revolution, and the trends that promise to drive market growth in the future.

2019 was a down-year for the small satellite sector overall, with only 189 satellites launched vs. 294 predicted. Commercial operators were largely to blame for the dip in industry performance, with a number of major operators launching fewer than expected numbers of satellites. As operators begin to reach the constellation sustainment phase, the industry will need new market entrants to sustain the exponential growth seen over the last 10 years.

SpaceWorks’ 2020 future projections have been updated accordingly and revised downward by approximately 15% to account for shifting industry dynamics, such as the slower-than-expected roll-out of new IOT/M2M constellations. Outstanding questions around the longevity of small satellite business models also present some concerns for near-term growth, but SpaceWorks remains bullish on long-term sector potential. Overall, SpaceWorks predicts 298 nano/microsatellites to launch in 2020, with as many as 2,400 expected to launch over the next five years.

Total satellite launch numbers are just the beginning of SpaceWorks’ 2020 Nano/Microsatellite Market Forecast. This special 10th anniversary edition explores how operators are striking the balance between capability and affordability, shines a spotlight on military interest, and investigates the role of technology demonstration missions in accelerating top-level industry growth. Take a look below for some of the biggest stories from the 2020 report:

Capability vs. Affordability

Average satellite size in the nano/microsatellite segment (1 – 50 kg) has risen dramatically over the last five years, from 4.7 kg per satellite in 2015 to 7.0 kg per satellite in 2019 (a delta of 30%+). As operators continue to search for the appropriate balance between capability and affordability, it seems that many are increasingly settling on larger satellite form factors. Looking forward, larger nanosatellite sizes (6U+) and microsatellites are expected to win-out and capture significant market share.

Spotlight on Military Interest

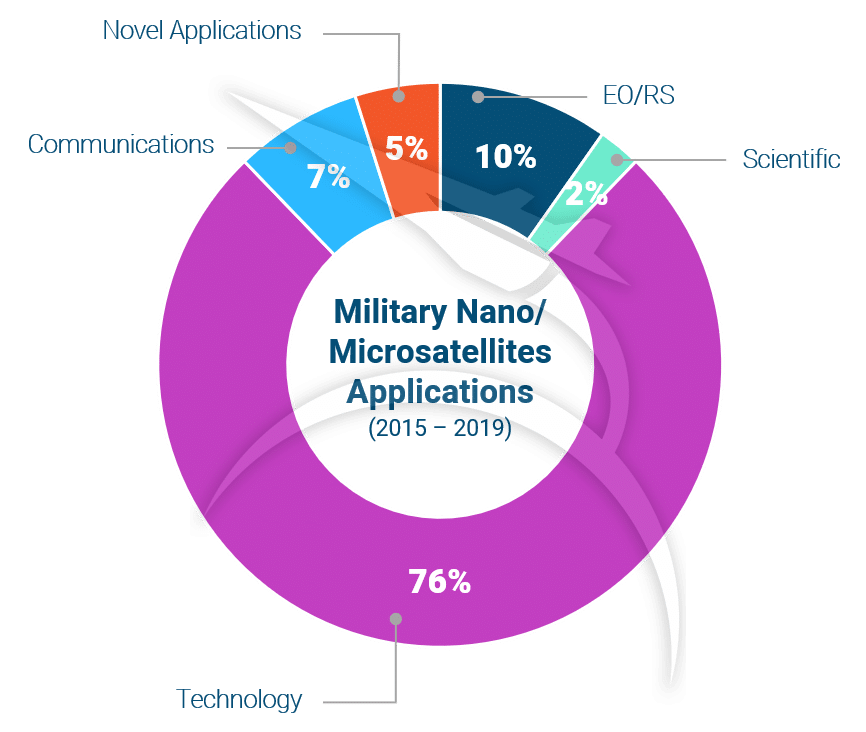

Military operators were some of the first adopters of the nanosatellite form factor, but their demand has been muted in comparison to commercial and civil operators in recent years. SpaceWorks research suggests that, at least historically, military operators have lacked confidence in the capabilities of small satellites and relegated their use almost exclusively to technology demonstration missions. Breaking out of the ‘technology demonstration box’ will require small satellites to demonstrate that they are, indeed, capable of executing mission critical objectives at a lower price point.

Maturing Technologies

Technology demonstration missions have been a mainstay of the small satellite segment since its inception, but what exactly are they demonstrating? SpaceWorks research suggests the majority of these missions aren’t just risk-reduction for the sake of risk-reduction. SpaceWorks finds that nearly 60% of technology demonstration missions are explicitly for the purpose of maturing specific components or subsystems. As the industry reaches a point of maturity, it appears that early investments are beginning to pay off – companies like NSLComm are capitalizing on these development efforts and creating enabling technologies for new small satellite business models.

The SpaceWorks 2020 Nano/Microsatellite Forecast closes by once again pointing out how new operators will be necessary to sustain future market growth projections. Successful fundraising rounds and technology demonstrations from companies like Fleet, Astrocast, and Capella, however, are providing confidence that the industry is well on its way to maturing the next generation of small satellite operators.