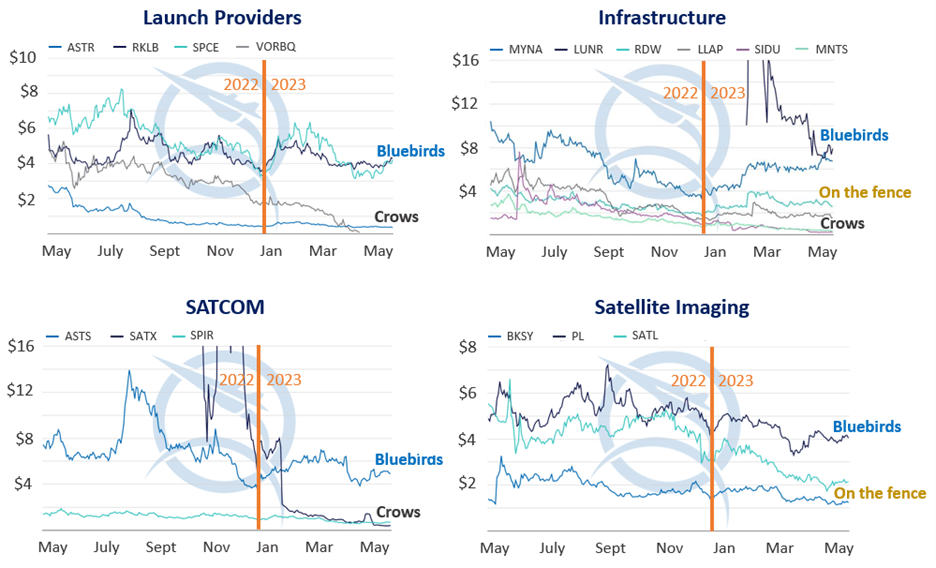

As 2022 ended, our review of the individual company tickers that comprise the SpaceWorks NewSpace Index (NSI) revealed the emergence of two major groups heading in different directions. The Bluebirds were hitting their targets and inspiring investor confidence while the Crows were burning through cash reserves and not showing enough for it. With the half-way point of 2023 on the horizon, a few more companies have clearly joined one of the two flocks while several are still sitting on the fence.

The separation is most obvious among the four public launch providers we cover in our NSI. Virgin Galactic (SPCE) and Rocket Lab (RKLB) are clearly Bluebirds in the eyes of public space company traders. Both stocks are holding relatively steady around $4 per share, after having just reported $392K (+23% YoY) and $55M (+35% YoY), respectively, in 1Q-2023 revenue. Meanwhile, Astra (ASTR) received a much-needed delisting extension from Nasdaq last month and Virgin Orbit (VORBQ) is on life support after extending their post-bankruptcy asset auction deadline to May 19th. Both are Crows in terms of their NSI performance.

In the infrastructure companies, Intuitive Machines (LUNR) and Mynaric AG (MYNA) are currently soaring together as Bluebirds. The former has an amazing opportunity to land on the moon later this year (See Commentary April 26, 2023) while the latter has rebounded from a low of $3.37 per share this past December all the way up to $7.60 per share upon the release of their full year 2022 financial results a few weeks ago. Unfortunately, Sidus Space (SIDU) and Momentus (MNTS) shares have continued to head in the opposite direction. Both have been sitting below $0.50 per share for more than a month now, placing them squarely amongst the Crows. Momentus hit some laudable technical milestones over the last few months, but they’ve burned up a worrisome amount of cash to do so. Then there is Terran Orbital (LLAP) and Redwire (RDW), who have yet to clearly join one of our two flocks. However, both recently released their 1Q-2023 financial reports and both missed analysts’ expectations. Terran Orbital lost $0.24 per share versus the expected $0.19 and Redwire lost $0.18 per share versus the expected $0.11. Do we hear cawing? Not encouraging news but there is still plenty of time to join the Bluebirds later this year. We are hopeful that these companies will see more positive stock price treatment in the NSI because they both continue to make excellent technical and financial progress from our perspective.

Currently trending at about $5.13 per share with their recently released 1Q-2023 financials, AST Spacemobile (ASTS) is the sole member of the Bluebirds for the SATCOM companies. The Crows now include Satixfy (SATX), which has been tracking at approximately $0.45 per share, about $0.25 below Spire (SPIR), which received their own Nasdaq delisting warning this past March. Finally, Planet Labs (PL) stands out as a Bluebird for the Satellite Imaging Companies. Satellogic (SATL) and BlackSky (BKSY) have yet to clearly break toward either of our flocks in the eyes of traders. Though BlackSky did see a nice little bump in their stock price after hitting their 1Q-2023 earnings target despite falling short on their revenue target.

The innovative nature of the NewSpace industry is boom or bust. Companies can be flying high one day and then literally be watching their future disintegrate the next. Alternatively, bankrupt companies can be resurrected to succeed in a new form. It’s important to remember that while birds of a feather flock together, any one of them can change their flight path and upon doing so, may quickly find themselves in formation next to new companions.